All Categories

Featured

Table of Contents

Another possibility is if the deceased had a present life insurance policy plan. In such cases, the marked recipient might obtain the life insurance policy earnings and utilize all or a portion of it to pay off the home mortgage, allowing them to stay in the home. loans insurance. For people that have a reverse mortgage, which allows people aged 55 and over to get a mortgage based on their home equity, the car loan rate of interest accumulates in time

Throughout the residency in the home, no settlements are called for. It is essential for people to thoroughly prepare and take into consideration these variables when it comes to home mortgages in Canada and their influence on the estate and beneficiaries. Looking for advice from legal and economic experts can aid make sure a smooth shift and proper handling of the home mortgage after the house owner's passing.

It is important to comprehend the readily available choices to guarantee the home loan is properly managed. After the fatality of a homeowner, there are a number of options for home loan settlement that depend on numerous elements, consisting of the regards to the home loan, the deceased's estate preparation, and the wishes of the beneficiaries. Below are some typical alternatives:: If multiple heirs want to think the mortgage, they can end up being co-borrowers and proceed making the mortgage payments.

This option can supply a tidy resolution to the mortgage and disperse the continuing to be funds among the heirs.: If the deceased had an existing life insurance policy policy, the marked recipient might obtain the life insurance coverage proceeds and use them to repay the home mortgage (mppi cover). This can enable the beneficiary to remain in the home without the concern of the home loan

If no one proceeds to make home mortgage payments after the homeowner's fatality, the home mortgage lender deserves to confiscate on the home. Nonetheless, the influence of foreclosure can vary relying on the scenario. If an heir is named however does not market your home or make the mortgage payments, the mortgage servicer might launch a transfer of ownership, and the foreclosure could significantly harm the non-paying heir's credit.In cases where a house owner passes away without a will or depend on, the courts will select an executor of the estate, usually a close living family member, to distribute the possessions and liabilities.

Best Mortgage Protection Companies

Home loan defense insurance (MPI) is a form of life insurance that is specifically designed for people that desire to make certain their home mortgage is paid if they pass away or come to be impaired. Occasionally this kind of policy is called home mortgage settlement security insurance.

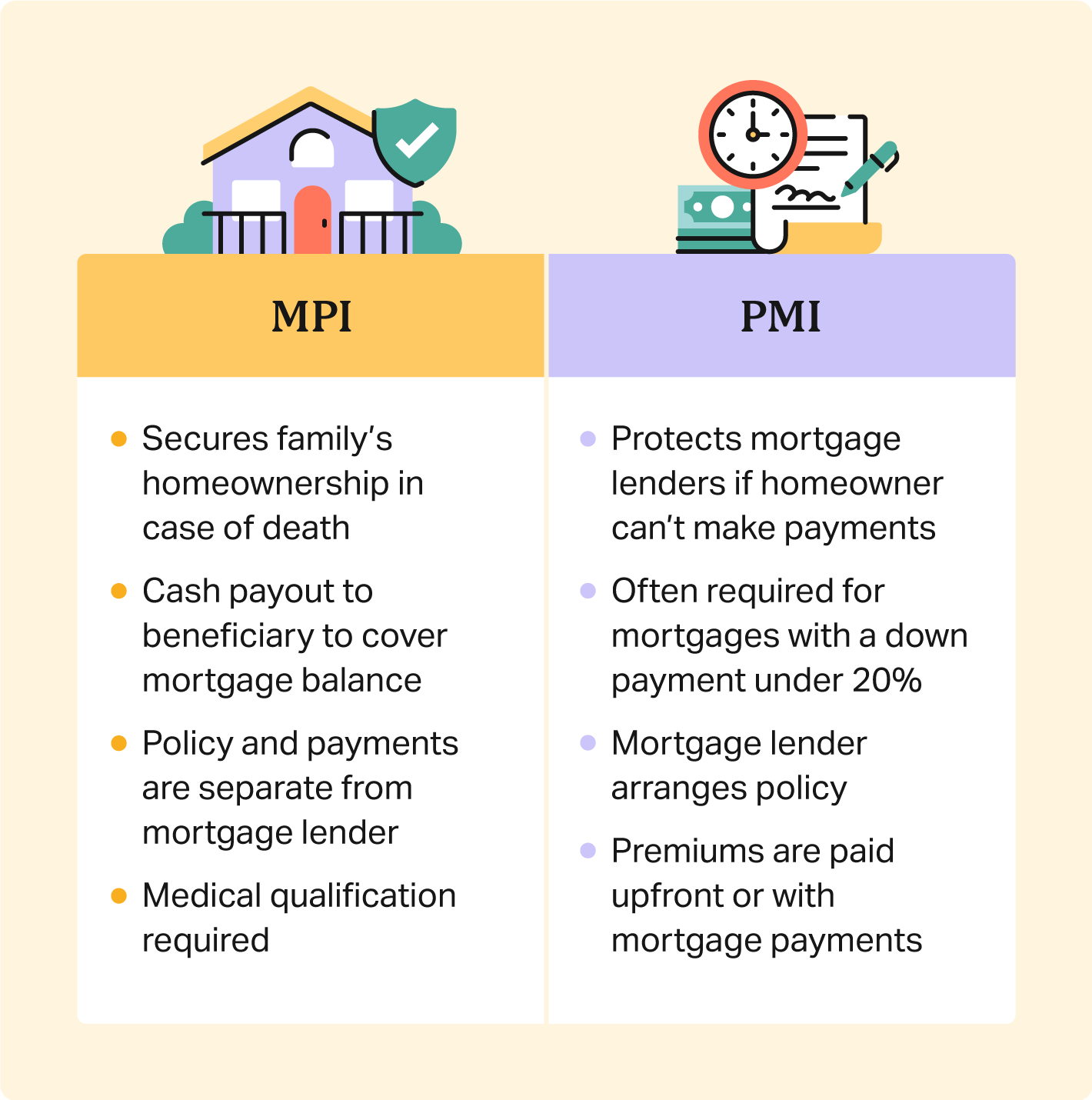

When a financial institution owns the huge bulk of your home, they are liable if something occurs to you and you can no more pay. PMI covers their danger in case of a foreclosure on your home (insured mortgage definition). On the other hand, MPI covers your danger in case you can no more pay on your home

MPI is the kind of home loan security insurance coverage every home owner should have in position for their household. The amount of MPI you need will differ depending on your one-of-a-kind circumstance. Some variables you should take into consideration when taking into consideration MPI are: Your age Your health Your financial situation and resources Other kinds of insurance policy that you have Some individuals may think that if they presently own $200,000 on their home loan that they must acquire a $200,000 MPI plan.

Mortgage Care Insurance

The questions individuals have concerning whether or not MPI is worth it or not are the same questions they have about getting other kinds of insurance in general. For the majority of people, a home is our solitary biggest financial debt.

The combination of tension, grief and changing family members dynamics can trigger also the most effective intentioned individuals to make pricey blunders. insurance that pays off mortgage if i die. MPI solves that problem. The value of the MPI policy is straight linked to the balance of your mortgage, and insurance policy profits are paid straight to the financial institution to look after the staying equilibrium

And the biggest and most stressful economic issue dealing with the surviving family participants is dealt with instantly. If you have health and wellness issues that have or will certainly create troubles for you being approved for regular life insurance, such as term or entire life, MPI could be an exceptional alternative for you. Typically, mortgage protection insurance plan do not call for clinical examinations.

Historically, the amount of insurance protection on MPI plans dropped as the balance on a mortgage was lowered. Today, the protection on the majority of MPI plans will stay at the same level you bought. If your initial home loan was $150,000 and you bought $150,000 of home loan defense life insurance, your beneficiaries will currently receive $150,000 no issue how a lot you owe on your home loan.

If you wish to repay your mortgage early, some insurance firms will permit you to transform your MPI plan to one more kind of life insurance policy. This is among the questions you may desire to address in advance if you are thinking about repaying your home early. Prices for home loan defense insurance policy will differ based upon a number of things.

Typical Cost Of Mortgage Insurance

One more variable that will certainly affect the costs quantity is if you get an MPI policy that supplies insurance coverage for both you and your spouse, giving benefits when either one of you dies or ends up being disabled. Know that some firms may require your plan to be editioned if you refinance your home, but that's commonly just the case if you got a plan that pays out only the balance left on your home mortgage.

Therefore, what it covers is really slim and plainly specified, relying on the choices you select for your specific policy. Self-explanatory. If you die, your home loan is settled. With today's plans, the value might exceed what is owed, so you might see an extra payment that might be utilized for any kind of undefined usage.

For mortgage security insurance, these types of additional insurance coverage are added to plans and are called living advantage riders. They permit plan owners to tap right into their home mortgage defense benefits without diing. Below's exactly how living benefit bikers can make a mortgage protection policy more beneficial. In instances of, many insurer have this as a totally free advantage.

For situations of, this is normally now a free living advantage provided by a lot of business, yet each business specifies advantage payouts in a different way. This covers ailments such as cancer, kidney failing, cardiovascular disease, strokes, mind damages and others. home mortgage protection act. Firms normally pay out in a lump amount depending upon the insured's age and extent of the illness

In some situations, if you make use of 100% of the permitted funds, then you utilized 100% of the policy fatality benefit value. Unlike a lot of life insurance coverage policies, purchasing MPI does not need a clinical examination a lot of the moment. It is offered without underwriting. This means if you can not get term life insurance policy as a result of an ailment, an ensured issue home mortgage security insurance coverage policy might be your best choice.

When possible, these should be individuals you recognize and count on that will certainly provide you the very best advice for your scenario. Despite that you decide to discover a plan with, you should always look around, due to the fact that you do have choices - home loan repayment insurance. In some cases, unexpected fatality insurance is a far better fit. If you do not get term life insurance policy, after that unintended fatality insurance coverage might make more feeling because it's assurance problem and indicates you will not undergo medical examinations or underwriting.

Home Insurance With Home Loan

See to it it covers all costs associated with your home mortgage, including interest and repayments. Think about these elements when choosing specifically just how much protection you believe you will require. Ask exactly how swiftly the plan will be paid if and when the primary income earner passes away. Your household will be under sufficient psychological stress and anxiety without needing to question just how long it may be before you see a payout.

Table of Contents

Latest Posts

Real Life Funeral Insurance

Senior Burial Insurance

Budget Funeral Cover

More

Latest Posts

Real Life Funeral Insurance

Senior Burial Insurance

Budget Funeral Cover