All Categories

Featured

Table of Contents

That typically makes them a much more cost effective alternative permanently insurance policy protection. Some term policies might not maintain the costs and survivor benefit the exact same over time. Term life insurance for couples. You don't desire to wrongly believe you're purchasing level term protection and after that have your death benefit change later. Many individuals obtain life insurance policy coverage to assist monetarily shield their liked ones in situation of their unexpected fatality.

Or you might have the option to convert your existing term coverage right into a permanent plan that lasts the rest of your life. Different life insurance coverage policies have potential advantages and drawbacks, so it is necessary to comprehend each prior to you make a decision to buy a policy. There are several benefits of term life insurance coverage, making it a popular selection for protection.

As long as you pay the costs, your recipients will certainly get the survivor benefit if you die while covered. That said, it is essential to keep in mind that the majority of plans are contestable for 2 years which indicates coverage could be retracted on death, should a misstatement be located in the application. Plans that are not contestable often have actually a rated survivor benefit.

What is Term Life Insurance For Couples? What You Should Know?

Costs are usually less than whole life policies. With a level term policy, you can select your insurance coverage quantity and the policy length. You're not locked into a contract for the rest of your life. Throughout your plan, you never ever have to fret about the costs or death advantage amounts transforming.

And you can not pay out your plan during its term, so you will not get any kind of monetary benefit from your past protection. As with other kinds of life insurance policy, the price of a degree term policy depends on your age, protection requirements, work, way of life and health. Commonly, you'll locate much more inexpensive protection if you're younger, healthier and less risky to insure.

Given that degree term costs stay the same for the duration of insurance coverage, you'll know exactly just how much you'll pay each time. That can be a big assistance when budgeting your costs. Level term coverage likewise has some adaptability, enabling you to tailor your policy with additional functions. These frequently can be found in the form of riders.

What is Term Life Insurance Level Term and How Does It Work?

You might have to meet certain problems and credentials for your insurance company to enact this motorcyclist. There likewise might be an age or time restriction on the protection.

The fatality benefit is commonly smaller sized, and insurance coverage normally lasts till your youngster transforms 18 or 25. This motorcyclist might be a much more cost-effective means to help ensure your youngsters are covered as motorcyclists can commonly cover several dependents at the same time. Once your child ages out of this coverage, it might be feasible to transform the cyclist right into a new plan.

The most usual type of permanent life insurance policy is whole life insurance coverage, however it has some vital differences contrasted to degree term protection. Below's a basic overview of what to think about when contrasting term vs.

What is Short Term Life Insurance? A Guide for Families?

Whole life entire lasts insurance coverage life, while term coverage lasts for a specific periodCertain The costs for term life insurance are generally lower than entire life insurance coverage.

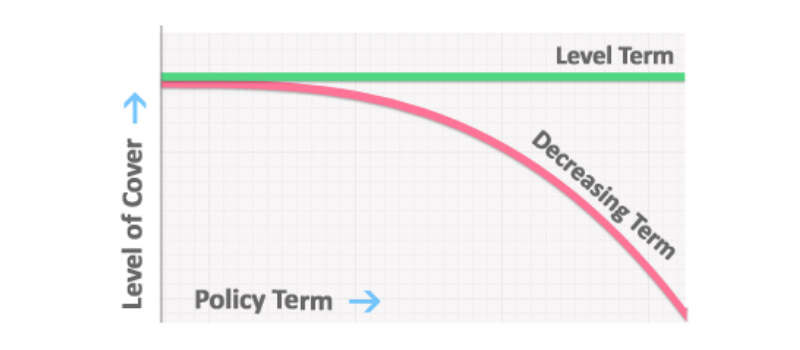

One of the primary attributes of level term insurance coverage is that your costs and your fatality benefit do not transform. With decreasing term life insurance policy, your costs continue to be the very same; nevertheless, the death advantage quantity obtains smaller with time. You may have coverage that begins with a fatality advantage of $10,000, which can cover a mortgage, and then each year, the fatality benefit will lower by a set amount or percent.

As a result of this, it's often an extra cost effective type of level term coverage. You might have life insurance policy through your employer, but it may not be adequate life insurance policy for your demands. The initial step when getting a plan is figuring out just how much life insurance coverage you require. Think about factors such as: Age Family members size and ages Work status Revenue Debt Way of living Expected final costs A life insurance policy calculator can assist figure out just how much you need to start.

The Ultimate Guide: What is Guaranteed Level Term Life Insurance?

After selecting a plan, finish the application. For the underwriting process, you might need to provide basic individual, health and wellness, lifestyle and employment details. Your insurer will certainly identify if you are insurable and the risk you may provide to them, which is reflected in your premium expenses. If you're approved, authorize the documentation and pay your first costs.

Ultimately, consider organizing time each year to assess your policy. You may wish to update your beneficiary information if you have actually had any kind of substantial life modifications, such as a marriage, birth or separation. Life insurance policy can in some cases really feel challenging. Yet you do not need to go it alone. As you discover your alternatives, consider reviewing your demands, wants and worries about an economic specialist.

No, degree term life insurance coverage doesn't have cash worth. Some life insurance policy plans have a financial investment function that allows you to construct cash worth gradually. A portion of your premium settlements is alloted and can earn interest over time, which expands tax-deferred during the life of your protection.

You have some options if you still desire some life insurance coverage. You can: If you're 65 and your insurance coverage has actually run out, for instance, you might desire to buy a brand-new 10-year level term life insurance plan.

Why Level Term Vs Decreasing Term Life Insurance Could Be the Best Option?

You might be able to convert your term coverage into a whole life policy that will last for the remainder of your life. Several kinds of degree term policies are convertible. That suggests, at the end of your coverage, you can convert some or every one of your policy to entire life insurance coverage.

A degree premium term life insurance policy plan allows you stay with your budget while you aid safeguard your family. Unlike some stepped price strategies that enhances every year with your age, this sort of term plan offers prices that remain the very same through you select, even as you grow older or your wellness modifications.

Discover more concerning the Life insurance policy alternatives offered to you as an AICPA participant (Level benefit term life insurance). ___ Aon Insurance Coverage Services is the brand name for the broker agent and program administration procedures of Affinity Insurance coverage Providers, Inc. (TX 13695) (AR 100106022); in CA & MN, AIS Affinity Insurance Coverage Firm, Inc. (CA 0795465); in Alright, AIS Affinity Insurance Policy Services Inc.; in CA, Aon Fondness Insurance Services, Inc .

Table of Contents

Latest Posts

Real Life Funeral Insurance

Senior Burial Insurance

Budget Funeral Cover

More

Latest Posts

Real Life Funeral Insurance

Senior Burial Insurance

Budget Funeral Cover